Trading on platforms like Pocket Option can be both exciting and challenging. Understanding the pocket option trading strategy pocket option trading strategy is crucial for any trader looking to maximize their profits and minimize risks. In this article, we will delve into various strategies that can enhance your trading approach and help you build a sustainable trading practice.

The Basics of Pocket Option Trading

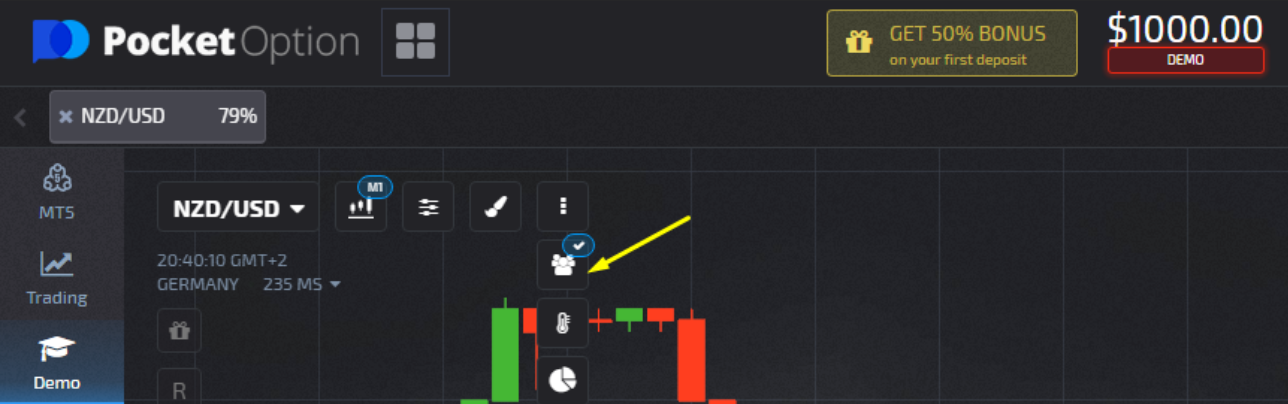

Pocket Option is a binary options trading platform that allows users to trade a variety of assets including currencies, commodities, and stocks. It offers a user-friendly interface and a range of tools that make it accessible to both beginners and experienced traders. Before diving into specific trading strategies, it’s essential to understand some fundamental concepts of binary options trading.

Understanding Binary Options

Binary options trading involves predicting the direction of an asset’s price (up or down) within a specific timeframe. If your prediction is correct, you earn a predetermined payout; if not, you lose your investment. This simplicity makes binary options an appealing choice for many traders.

Key Terminology

- Asset: The financial instrument being traded (e.g., currency pairs, stocks, etc.).

- Trade Duration: The time frame in which the trader expects the price of the asset to move.

- Payout: The amount you earn if your trade is successful, often expressed as a percentage of your investment.

- Risk Management: A strategy to minimize potential losses in trading.

Developing Your Pocket Option Trading Strategy

Creating a successful trading strategy requires a combination of education, practice, and analysis. The most effective strategies typically blend technical analysis, fundamental analysis, and risk management techniques. Below are some strategies that can be utilized on the Pocket Option platform.

1. Trend Following Strategy

The trend-following strategy is built on the idea that assets which have been moving in a particular direction will continue to move in that direction. To implement this strategy:

- Identify the trend using technical indicators such as moving averages.

- Open a trade in the direction of the trend.

- Utilize risk management techniques to limit potential losses.

Tools for Trend Analysis

Common tools for analyzing trends include:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Bollinger Bands

2. Breakout Strategy

The breakout strategy involves entering the market when the price of an asset breaks through a defined support or resistance level. Traders often look for volume spikes and confirmation signals to validate a breakout. Here’s how to implement it:

- Identify significant support and resistance levels on the price chart.

- Wait for a breakout with increased volume.

- Place a trade in the direction of the breakout.

Using Breakout Indicators

Popular indicators for identifying breakouts include:

- Volume analysis

- Average True Range (ATR)

- Chart patterns (e.g., triangles, flags)

3. Star Patterns Strategy

Star patterns, particularly shooting stars and morning stars, can provide unique trading signals. These candlestick patterns indicate potential reversals in market direction. To trade using star patterns:

- Identify the formation of a star pattern on your charts.

- Confirm with other indicators, such as RSI or MACD.

- Place a trade based on your confirmation.

Recognizing Star Patterns

Star patterns consist of three candlesticks, where the middle candlestick is a small body that gaps away from the previous trend. Understanding these patterns can give you valuable insights into potential price reversals.

4. Swing Trading Strategy

Swing trading involves taking advantage of short-term price moves within a larger trend. This strategy is suitable for traders who cannot dedicate all day to trading but still want to capture market moves. Implement this strategy by:

- Identifying price swings on the chart.

- Using technical indicators to confirm entry and exit points.

- Applying stop-loss and take-profit orders effectively.

Key Indicators for Swing Trading

Some indicators that can help in swing trading include:

- Moving Averages

- Stochastic Oscillator

- MACD

Risk Management in Pocket Option Trading

No trading strategy is complete without an effective risk management plan. Understanding how to manage your risks can greatly enhance your trading success. Here are several key components:

1. Determine Your Risk Tolerance

Before you begin trading, establish how much you are willing to risk on each trade. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

2. Use Stop-Loss Orders

Utilizing stop-loss orders can help protect your investments by automatically closing a position at a predetermined price point, limiting potential losses.

3. Diversification

Spread your investments across different assets or strategies to reduce overall risk. Diversification can help mitigate potential losses from any single trade or asset.

Conclusion

Trading on Pocket Option can be highly rewarding if approached with the right strategies and risk management techniques. Whether you choose to follow the trend, identify breakouts, trade star patterns, or swing trade, it’s essential to stay informed, analyze the market, and continuously refine your strategies. With persistence, patience, and practice, you can navigate the world of binary options trading successfully.